What Everybody Ought To Know About How To Sell Call Options

![How To Sell A Put Option - [Option Trading Basics] - Tradersfly](https://i.ytimg.com/vi/SAgkEWTGTDw/maxresdefault.jpg)

Find the stock you’d like to sell a call option for.

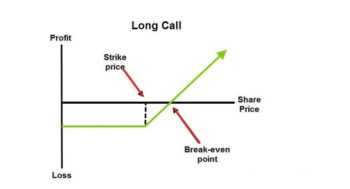

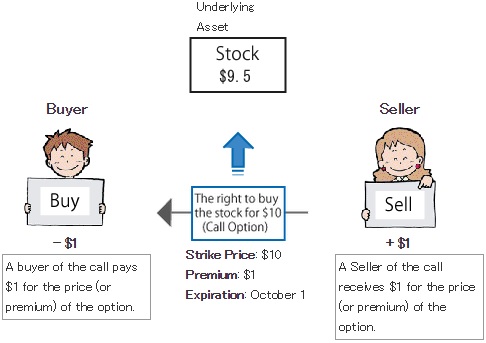

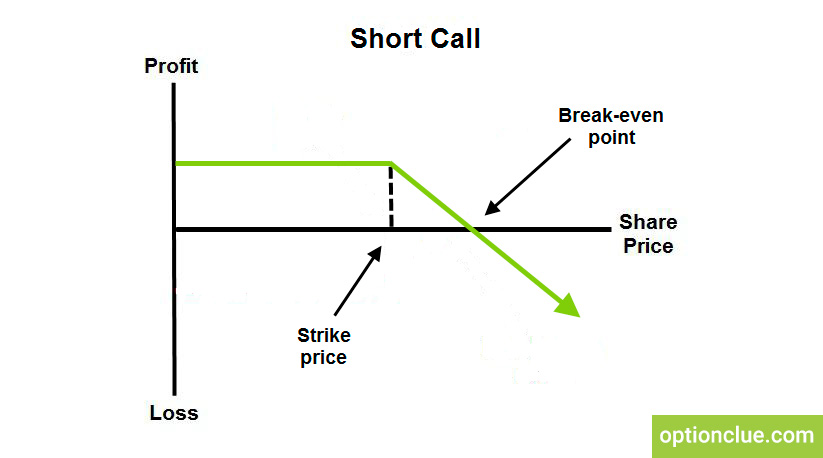

How to sell call options. You sell a call option consisting of the right to purchase 100 shares of a stock before the expiration date of the contract for a set price. In this video, i'll explain how to sell covered calls to help you make some simple side money!🔗. You sell a call option with a.

With a covered call, a trader makes two actions: Selling a call is not as easy as it might seem due to order types (e.g., open or close). You own shares of a stock (or etf) that you would be willing to sell.

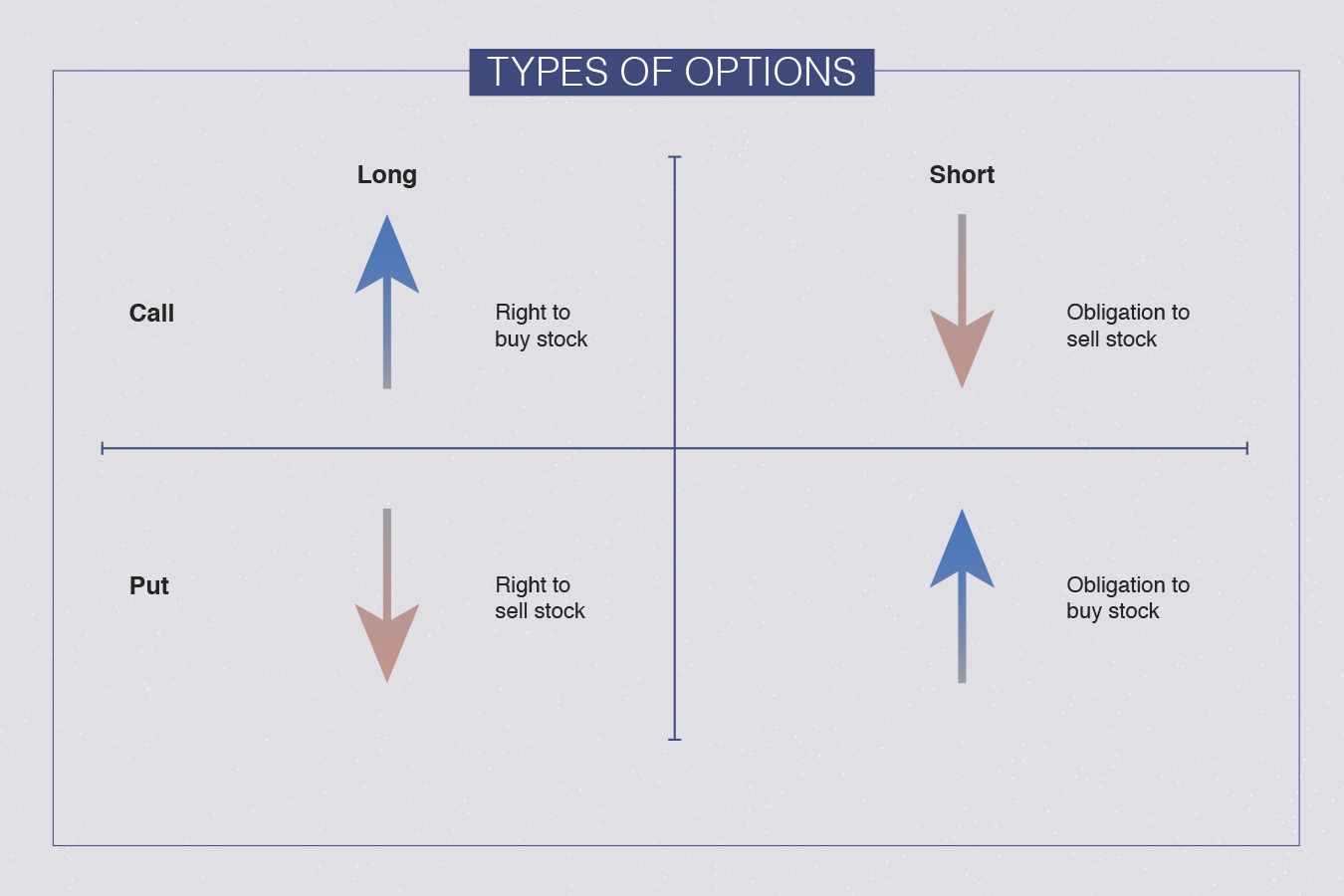

Buying a call option, selling a call option, buying a put option, and selling a put option. There are four basic options positions: This part is the same no matter.

Conversely, buying a put option gives the owner the right to sell the underlying security at the option exercise price. Intrinsic value, time value, and time decay. Selling calls selling options involves covered and uncov… see more

Covered call options are an easy source of passive income! You are selling the call (you’re short, buyer is long) to an options buyer because your believe that the price of the stock is going to fall, while the buyer believes it is going up. A call option writer stands to make a profit if the underlying stock stays below the strike price.after writing a put option, the trader profits if the price stays above the strike price.

Once you’ve picked a stock, a new page will open,. Selling calls the purchaser of a call option pays a premium to the writer for the right to buy the underlying at an agreed upon price in the. You determine the price at which you’d be willing to sell your stock.

An investor would choose to sell a naked put option if their outlook on the underlying security was that it was going to rise, as opposed to a put buyer whose outlook. Many people don’t understand that you can actually sell option contracts without having the stock, or without owning the other option side of the trade.selli. To do so, tap the magnifying glass in the top right corner of your home screen.

A covered call is a strategy used by options traders to hedge against the risk of a long position. Then, he or she would make the appropriate selections (type of option, order type, number of options, and expiration month) to place the order. With call options, the buyer is.

For review, a call option gives the buyer of the option the right, but not the obligation, to buy the underlying stock at the option. Thus, buying a call option is a bullish bet—the owner. A chart explaining how the payoff work.

Once your order is submitted, it will be routed to the market to. Once an option has been selected, the trader would go to the options trade ticket and enter a sell to open order to sell options. Just remember each option contract controls 100 shares of stock, so if you own 500 shares of a stock you would sell 5 call options, not 500.

:max_bytes(150000):strip_icc()/NakedCallWriting-AHighRiskOptionsStrategy2_2-aab223af50cc44ba9a0f874609356225.png)

/Clipboard01-617b9d39bcc744d691fc612f569587e0.jpg)

![How To Sell A Put Option - [Option Trading Basics] - Tradersfly](https://tradersfly.com/wp-content/uploads/2019/06/2017-07-27-selling-put-options-single-263.jpg)

![How To Sell A Call Option - [Option Trading Basics] - Tradersfly](https://tradersfly.com/wp-content/uploads/2019/06/2017-07-27-selling-call-options-single-296.jpg)

:max_bytes(150000):strip_icc()/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)

:max_bytes(150000):strip_icc()/Clipboard01-617b9d39bcc744d691fc612f569587e0.jpg)