Perfect Tips About How To Avoid Credit Card Finance Charge

As long as you pay your full balance within the.

How to avoid credit card finance charge. Five tips to avoid finance charge on your credit card 1. Foreign currency purchases using a credit card abroad is good, but it may be costly. How to avoid finance charges.

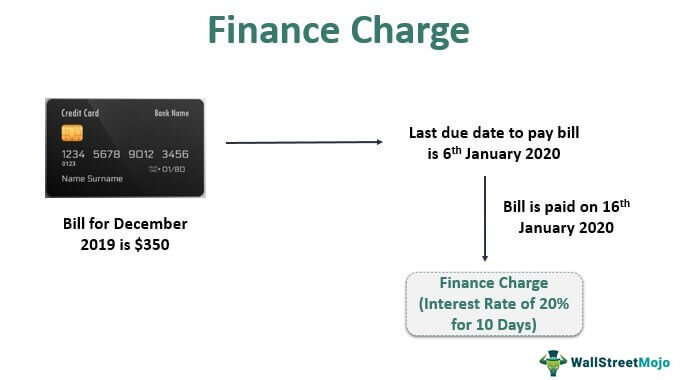

Since finance charges are the credit card issuer’s way of charging you for carrying a balance, the simple way to avoid finance charges is to pay your full balance each month. So, how can one save money on finance charges? There are a few possible ways credit card issuers can compute your finance charge, but most work it out on a daily basis using the average daily balance method.

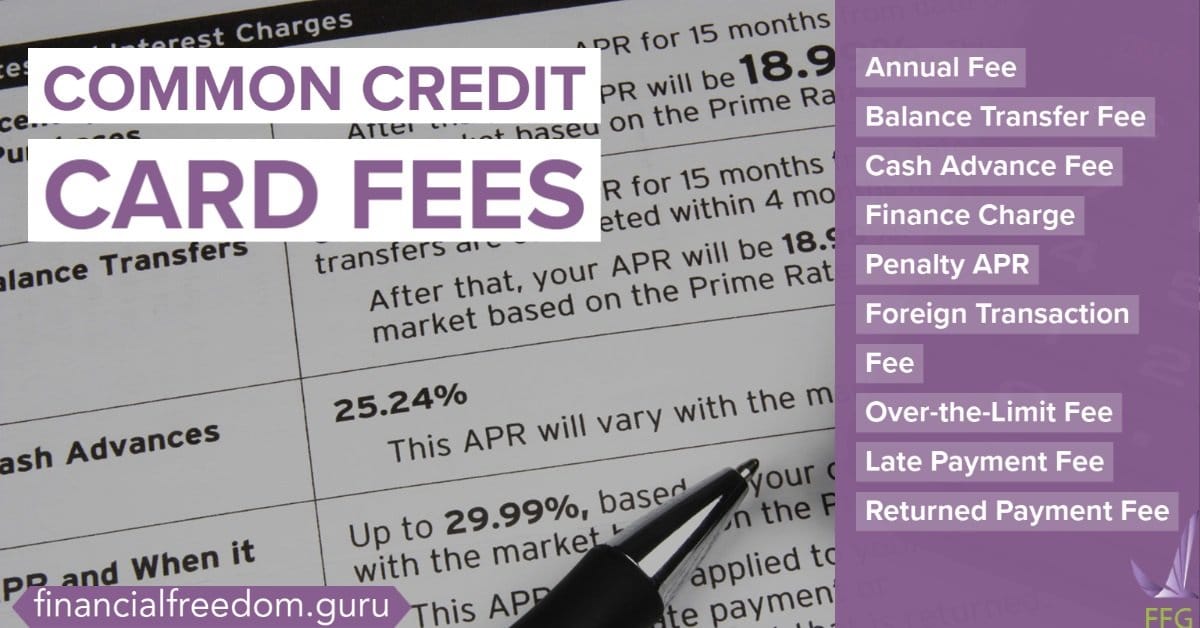

The cfpb suggests taking the extra step of calling your. Pay your credit during the grace period conventionally, most credit cards have a grace period between 21 to 25 days,. Your credit card finance charge relies on the three factors mainly:

Avoid credit card finance charges pay your balance in full. Don’t use credit cards abroad. Since finance charges are the credit card issuer's way of charging you for carrying a balance, the simple way to avoid finance charges is to pay your full balance each month.

How to avoid finance charges. Annual percentage rate (apr) the amount of your debt; With credit cards, the easiest way to save money is by paying off the full outstanding balance on the customer’s credit card.

Find your apr on your credit card statement, then divide it by 365; Save 50% or more monthly. To avoid or minimize international credit card fees, you may want to check your cardholder agreement for details.

It is directly linked to a card’s annual percentage rate and is calculated based on the. Credit cards are required to give you what’s. Ad we've rated the best options for getting out of debt.

By paying your balance in full every month, your credit card will not issue a finance charge. Pay off your balance at the end of every billing cycle. A credit card’s finance charge is the interest fee charged on revolving credit accounts.

How to avoid a finance charge on your credit card always read the terms of your promotional offers to know whether. The best way to avoid finance charges is by paying your balances in full and on time each month. The easiest way to avoid finance charges is to pay your balance in full and on time every month.

How the finance charge is calculated? Finance charge simply refers to the interest that you are charged on a debt that you owe, and is generally used in the context of credit card debt. Look at the best apr offers if you need.